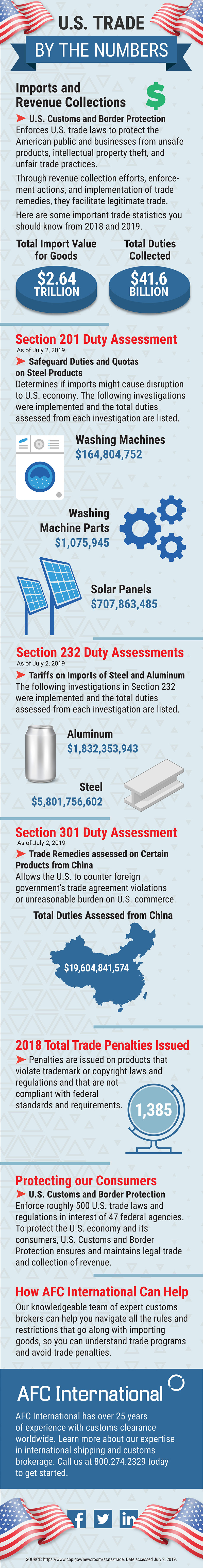

The United States Customs and Border Protection enforces U.S. trade laws to protect the American public and businesses from unsafe products, intellectual property theft, and unfair trade practices. Through revenue collection efforts, enforcement actions, and implementation of trade remedies, they facilitate legitimate trade. Here are some important U.S. trade numbers you should know from 2018 and 2019.

Total Import Value for Goods – $2.64 Trillion

Total Duties Collected – $41.6 Billion

Section 201 Duty Assessment

Section 201 is a series of safeguard duties and quotas on steel products. It determines if imports of steel products might cause disruption to the U.S. economy. The following investigations were implemented and the total duties assessed as of July 2, 2019.

Washing Machines – $164,804,752

Washing Machine Parts – $1,075,945

Solar Panels – $707,863,485

Section 232 Duty Assessment

These investigations deemed that quantities of steel and aluminum imports “threaten to impair U.S. national security.” In turn, the current President imposed restrictions on aluminum and steel. The following investigations were implemented and the total duties assessed as of July 2, 2019.

Aluminum – $1,832,353,943

Steel – $5,801,756,602

Section 301 Duty Assessment

These trade remedies, which are still in negotiation as of 2019, have been placed on certain products from China. These tariffs allow the U.S. to counter foreign government’s trade agreement violations or unreasonable burden on U.S. commerce. To read each of the full lists of products, go to The Office of the U.S. Trade Representative official website. The following investigations were implemented and the total duties assessed as of July 2, 2019.

Total Duties Assessed from China – $19,604,841,574

2018 Total Trade Penalties and Liquidated Damages Issued

Over 1,300 penalties were issued in 2018. The CBP also issued over 9,000 Liquidated Damages cases resulting in $15.5 million dollars in penalty and liquidated damages collections. These were issued, in part, on products that violated trademark, copyright laws and as well as other Customs and government regulations.

Protecting Our Consumers

The United States Customs and Border Protection agency enforces roughly 500 U.S. trade laws and regulations. To protect the U.S. economy, the U.S. Customs and Border Protection agency helps to maintain legal trade and collection of revenue.

How AFC International Can Help

Our expert customs brokers ensure that you navigate all the rules and restrictions that go along with importing your specific goods. Customs brokers give you the tools to better understand the U.S. trade numbers and programs and can also help you avoid trade penalties.

Working with a licensed customs broker that utilizes the best resources for importing ensures your imports are filed properly and import clearance delays are avoided altogether.

Leave a Reply

You must be logged in to post a comment.